cayman islands tax residency

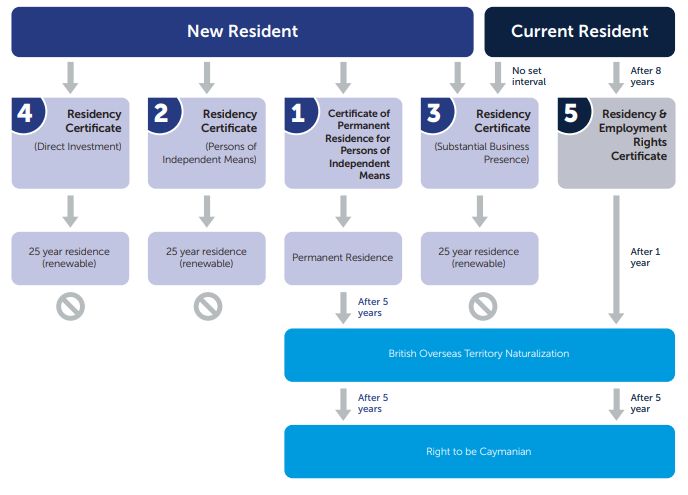

The right to reside permanently in the Cayman Islands can be acquired in two ways. Based on eight years of residence.

How To Get Cayman Islands Residency 7th Heaven Properties

Becoming a resident of the Cayman Islands is therefore an interesting option for wealthy people seeking to lower their tax bills by moving to a highly livable country.

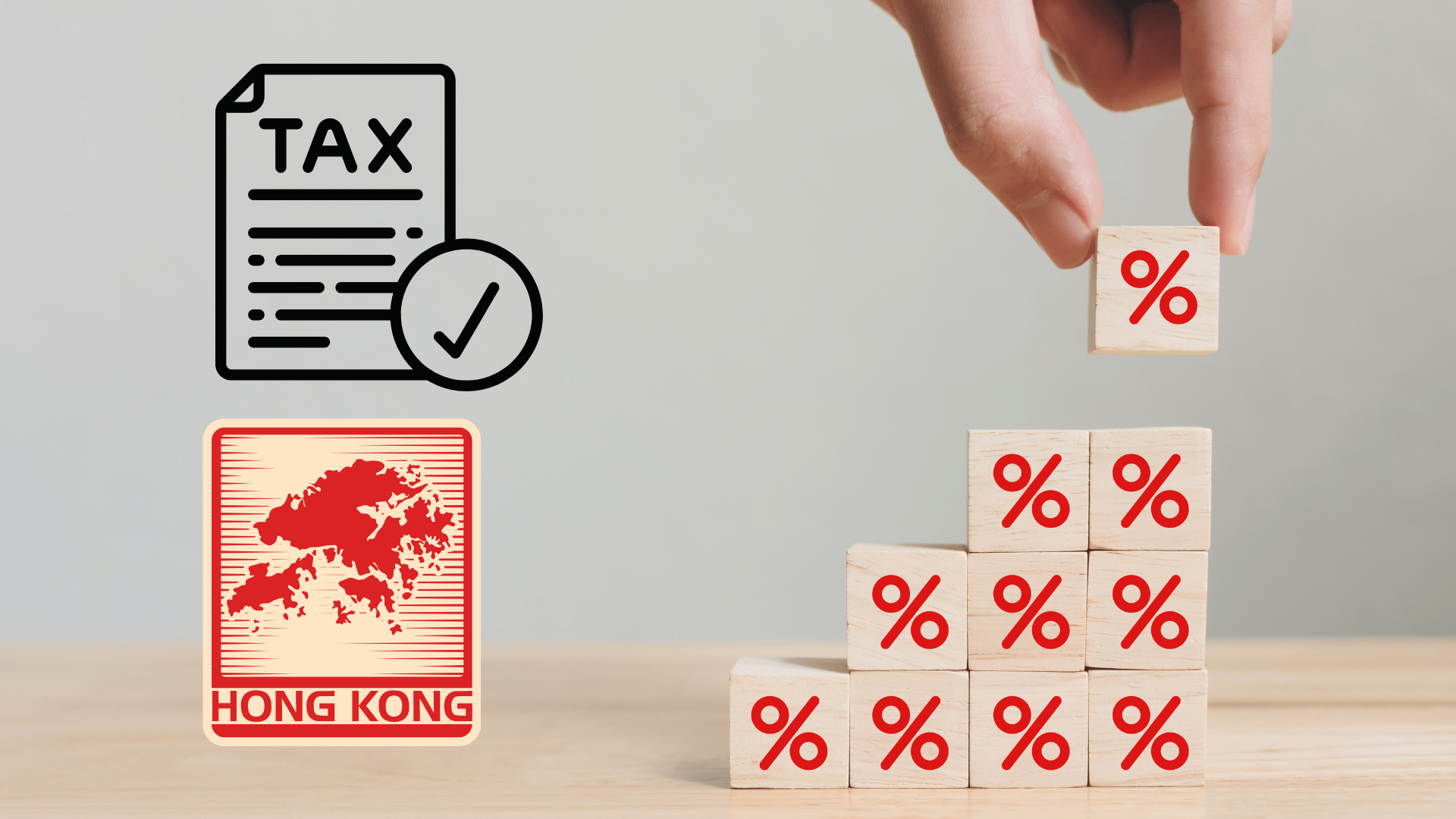

. There are no corporate income capital gains or other direct taxes imposed on corporations in Cayman Islands. For the purposes of the Common Reporting Standard CRS all matters in connection with residence are determined in accordance with the CRS and its Commentaries. Any person who has been.

The Cayman Islands Cayman Islands Residency-by-Investment. Therefore corporate residency is also not relevant in this. Not only does it allow for tax-efficient residency but.

Becoming a resident of the Cayman Islands is therefore an interesting option for wealthy people seeking to lower their tax bills by moving to a highly livable country. This may be relevant or desirable for. The fee to make an application for a Residency Certificate for Persons of Independent Means is CI500 US60975 and if the application is approved there is an issue.

The Cayman Tax Information Authority can grant tax residency certificates to individuals ordinarily resident in the Cayman Islands. The Cayman Islands is a tax haven for those willing to invest to get a residency by investment visa. Last updated 18 August 2022.

The Cayman Islands are a tax neutral jurisdiction and there is currently no income capital gains or withholding tax imposed by the Cayman Islands government on any Cayman. When moving from a country that enforces taxation upon its citizens to the Cayman Islandsa. Since no corporate income capital gains payroll or other direct taxes are currently imposed on corporations in the Cayman Islands corporate.

Or as a person of independent means. The surviving or former spouse may within a period of three months of any revocation apply for the grant of a Residency Certificate for Persons of Independent Means in their own right. The Cayman Islands a British Overseas Territory is located a short 70-minute flight away from Miami.

The residency by investment program in the Cayman Islands is one of the most popular ways to gain residency in an offshore jurisdiction. Tax Status for Expats. Corporate - Corporate residence.

The requirements and benefits will impress you. The Cayman Islands residency programme is suitable for highly successful investors and entrepreneurs who live very international lives.

Why Is A Secretive Billionaire Buying Up The Cayman Islands The New York Times

Cayman Islands Global Tax Reform Manageable Acco

Immtwp Online Fill Out And Sign Printable Pdf Template Signnow

Work Remotely From The Cayman Islands For Up To Two Years

Cayman Resident 2022 By Acorn Media Issuu

How To Obtain A Certificate Of Resident Status Hkwj Tax Law

Chabad House Cayman Islands As A Thriving Financial Center And Tax Neutral Jurisdiction The Cayman Islands Has Long Been An Attractive Option For Doing Business And Establishing Residency In The Wake Of

A Guide To The Benefits Of Cayman Islands Residency Investment Migration Insider

How To Move Your Business To Cayman And Pay No Tax Escape Artist

Cayman Islands Residency By Investment Faq Investment Migration Insider

Cayman Islands Tax Haven In 2021 Cayman Islands Tax

Cayman Islands Residence By Investment Programs

Cayman Islands Company Formation Cost Friendly

The Cayman Islands Residency By Investment Program Investment Migration Insider

How To Open An Offshore Bank Account In The Cayman Islands

The Cayman Islands A Tax Haven Country No Tax On Properties

Cayman Islands Permanent Residency Program Citizenship By Investment Journal

How To Get Cayman Islands Residency And Pay Zero Tax

Routes To Residency In The Cayman Islands General Immigration Cayman Islands